Cory M. Grenier, Flickr

Cory M. Grenier, Flickr

Will Housing Tip Another Goliath?

In the past month, fears regarding the Chinese economy were stoked by the continued devaluation of the Chinese yuan and subsequent decline in Chinese net exports. This unusual combination, alongside weak capital flows, suggest that the Chinese economy is experiencing the effects of falling global demand.

As the world’s second largest economy, the fall in the Chinese markets caused a dip in U.S. markets as well. However, the dip was quickly reversed by positive U.S. economic indicators last week, mainly increased consumer spending in the third quarter and promising evidence that the Fed may finally increase interest rates this December. In China, there was a recovery as well, fueled primarily by stimulus measures.

Fears of slowdown and collapse are prevalent in discourse concerning the Chinese economy, but there are some that disagree. In November 2015 Jonathan Woetzel published an article for McKinsey & Company, a global management consulting firm, outlining why five major structural deficiencies of the Chinese economy are actually overblown. It is Woetzel’s view that while the Chinese economy is slowing down, there is no evidence to support the claim that the Chinese economy is on the verge of collapse.

In some ways Woetzel is right, the Chinese economy may not collapse, and may continue to on its path towards secular stagnation. But there is a sector of the Chinese economy that Woetzel drastically underestimates: the housing market. Here is what you need to know:

- The Chinese economy is a hybrid one (not truly planned nor truly free market oriented) and the government manipulates housing prices by managing demand. They do so by regulating credit markets, managing administrative restrictions, and mortgage rules such that real-estate prices match GDP growth.

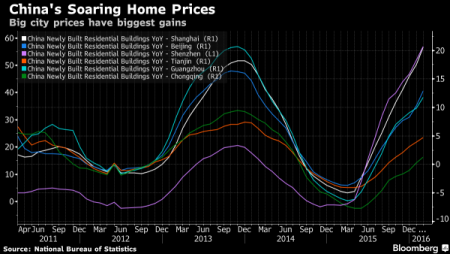

- Chinese housing prices, on average, have soared in the past year alone, rising 23%. Prices have not risen uniformly across the country, but price hikes in tier-2 cities still represent a major threat to economic stability.

- Chinese GDP growth has hovered between 7 and 6.7% in the past year, making this rapid rise in prices levels an indicator of an economic bubble.

- It is estimated that at least 70% of household wealth in China is invested in housing.

Bloomberg / National Bureau of Statistics

Similar to the period preceding the U.S. 2008 housing bubble burst, Chinese income and GDP growth are failing to match growing real estate prices. This has created incentive for the Chinese government to loosen restrictions on regulations in an effort to boost housing demand and hold off economic slowdown. This helps China reach its economic growth goals, but significantly increases the overall risk landscape because eventually the housing bubble will burst. What can we expect then?

- Infrastructure investment, historically critical for Chinese GDP growth but currently waning in effectiveness, will be hit the hardest. When real-estate value plummets, there will be no demand for a large portion of Chinese infrastructure industry, and the Chinese economy will surely struggle to recover.

- China’s high debt levels will make stimulus measures aimed at facilitating economic recovery more prolonged.

- Chinese household savings will be significantly reduced, and the most populous nation in the world will experience drastic decreases in household wealth.

The U.S. 2008 recession quickly became a global one due to the global reach of the American economy, and today, the world is still recovering. Many argue that global fall in demand, high debt levels, narrow monetary policy maneuverability, and geopolitical issues stifle potential growth and suggest a more permanent presence of secular stagnation for major economic powers. While secular stagnation is a major global concern, economists have ideas on how to proceed. Sustainable economic growth does not come from investment in infrastructure or any form of monetary policy. Instead, long-term growth can only come from increases in efficiency that stem from research and development and the expansion of resources.

For China, tightening regulations on spiking prices in the real-estate market, followed by a renewed effort to shift investment away from short term growth arenas and towards long term growth arenas is the answer. While local Chinese governments are attempting this, an effort must be made on the national level to make a larger impact. Otherwise, the housing market will tip over another economic goliath, and at a time when the global economic environment and outlook are particularly grim.

It’s not clear to me from this article that the housing market itself is highly over leveraged as the US market was in 2005 – 2008. What sort of mortgage market is there in China i.e. LTV ratios, job history, income levels, etc. Do they have credit scores as an underwriting tool ?