Energy: “Cause of and Solution to” the Puerto Rico debt crisis?

While the eyes of the world have focused this week on how Greece and the European Union will resolve (or kick the can) the latest crisis in the ongoing Greek financial crisis, there is also a debt crisis happening within the United States. On Monday, June 30, the Governor Alejandro Garcia Padilla of Puerto Rico announced that the island’s $73 billion in debt “not payable.” His analysis was based off a new report from former IMF Chief Economist Anne Krueger, “Puerto Rico – A Way Forward.”

The debt crisis in Puerto Rico is a symptom of almost a decade of economic decline in the island, and reading the Krueger report, it shows how a series of economic shocks have rocked the economy. From a housing shock to a credit-crunch, oil price increases to high labor costs, shocks have hurt both the aggregate demand and aggregate supply side of the economy.

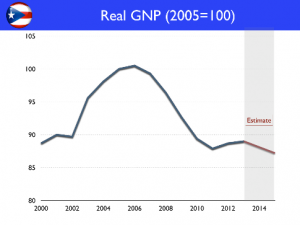

The result is that the Real GNP in Puerto Rico today is lower than it was in 2000. With such a collapse in economic growth, a debt crisis is nearly inevitable. This is not simply a case of a government living beyond its means. Every government and agency assumes that a rising economy will allow it to pay back its debt – when the economy is now 10% lower than it was 10 years ago, there’s simply no way to pay those debts.

The result is that the Real GNP in Puerto Rico today is lower than it was in 2000. With such a collapse in economic growth, a debt crisis is nearly inevitable. This is not simply a case of a government living beyond its means. Every government and agency assumes that a rising economy will allow it to pay back its debt – when the economy is now 10% lower than it was 10 years ago, there’s simply no way to pay those debts.

Energy at the Root of Puerto Rico’s Crisis

As the report makes clear, one of the central underlying causes of the crisis is the island’s failed energy policy. PREPA, the island’s electricity provider, is a government monopoly that has long resisted modernization. PREPA’s debt of $9 billion is a significant part of the $73 billion debt. Energy affects both the supply and demand side of the economic equation in Puerto Rico. The island is almost entirely dependent on imported fuels for it energy: according to the EIA, in 2013, 55% of Puerto Rico’s electricity came from petroleum, 28% from natural gas, 16% from coal, and 1% from renewable energy. As oil prices spiked upwards over the last decade, the economy was hurt far more than anywhere on the US mainland, where oil is only used in cars, not in electricity as well.

Economically, this has hurt both sides of the supply and demand curve: on the demand side, that represents capital that could have been used on Puerto Rico to pay debt and grow the economy. On the supply side, the high cost of electricity has discouraged manufacturers from investing in the island.

In the short term, it appears that the only way for Puerto Rico to escape its massive debt load is through some sort of managed default, whereby the island works with its creditors to restructure debt. However, in the longer term, the island needs to build a more competitive economy that can drive the economic growth needed to pay its debts. Unfortunately, a high debt load is not the only similarity Puerto Rico shares with Greece: because the island is tied in a currency union with a larger entity (in this case the US dollar, not the euro), it cannot devalue its currency in an effort to regain competitiveness. That means that increasing competitiveness must entail a long process of structural reforms to attract investment to the island.

An Energy Solution to the Crisis

Energy reform should be at the heart of these reforms. As the Krueger report says: “The drive for competitiveness must include a cut in high energy costs, which cascade down to the rest of the economy.” With electricity prices of 22 cents per kilowatt hour, electricity is more than three times as expensive as on the mainland. Energy reform is a crucial part of building this competitive economy. This crisis must force PREPA to reform itself. The Krueger report goes on to suggest that the utility should move to simply focus on transmission and marketing energy, while opening electricity generation to competition.

There are options. In February, at an American Security Project event on building energy security in the Caribbean, an executive of Tropigas detailed their proposal to replace PREPA’s oil fired electricity with propane (see below). This would allow cheaper electricity generation and more predictable prices. A similar project in the nearby US Virgin Islands is nearing completion by a consortium recently completed by Vitol. It has already reduced electricity prices by 20%, and the utility expects further cost declines.

Opening PREPA to deregulation would allow for cleaner fuels, lower costs, and increased usage of renewable energy. After all, even though Puerto Rico has little domestic fossil energy, any visitor will tell you there’s no shortage of sun and wind.

Energy was a part of the reason that Puerto Rico fell into its debt crisis. Energy should also be a way for the island to pull out of the crisis.

Luis Humberto Berrios, Vice President of Tropigas Puerto Rico, detail his proposal to power the island with Propane at the ASP’s February conference. Watch the panel discussion below, and read the event summary on ASP’s blog.

Truly? Puerto Rico has been buying the most expensive oil without political access to cheaper oil at the other side of the Caribbean; Venezuelan. It is was not a matter of price of oil but a matter of to whom we are buying it. While everyone had access to cheap oil we are not. To this you can add corruption schemes buying a premium certified low sulfur oil while the certifications were tarnished with greed since they were high sulfured and cheaper. Impunity reigns within the Power Authority, construction contracts unchecked by an independent third party. But beware all public authorities are in economic trouble practically at the same time, isn’t it something. Ports, Power , Water, Communications, our shipping company, and the Roads and public works authority. But the main question is were that money went? We are been ask to sacrifice and to pay for all this mess but where are the culprits? Politically we are not capable to cope with this mess, we do not have the basic instrument to deal with this. Is time for a PREXIT.