The United States is one of the most energy intensive developed economies, which makes its economy vulnerable to price fluctuations

Upward price shocks harm consumers by acting as a tax, but downward price shocks can harm producers as well by undermining long-term investments.

Short-term fuel prices should not factor into our long-term decisions. When deciding an energy choice, its economic stability – defined as how energy affects the health of the country’s economy over the long term – should be an important concern.

America’s Energy Market Profile

Oil

In addition to the long-term problems of supply and demand, oil suffers from the short-term problem of price volatility. The global price of oil fluctuated from an average price per barrel of $69 in 2007 to a peak of $147 in July 2008, back down below $35 in January 2009, then back up above $120 per barrel in April 2011. In 2013, the price averaged around $98 per barrel.

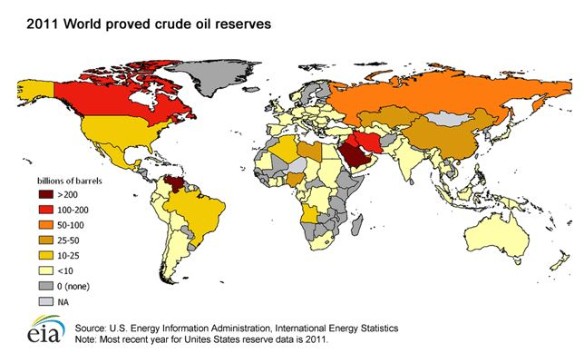

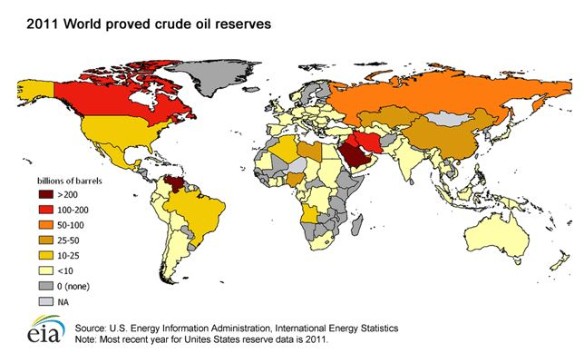

The U.S. is the world’s largest consumer of petroleum. In 2010, the U.S. consumed over $1.45 trillion worth of oil, of which $680 billion was spent on imports. In 2012, the U.S. consumed about 18.6 million barrels of oil per day, 40% of which was imported. The export of this capital has the effect of driving down the value of the dollar.

Coupled together, volatility and import dependence mean that rapid price increases act as a tax increase on consumers – but instead of this tax increase being used to pay down the budget deficit or invest domestically, 50% of it is sent overseas.

Coal

Coal

The dominance of coal in utility-scale electricity generation is because mining and transporting it has historically been cheap. However, the long-term cheapness of coal as a source of electric power may be beginning to come to an end. Railroads transport most coal production, and increasing demands on track along with industry consolidation mean that they can increase delivery prices of coal; for some coal deliveries, transportation costs account for 50% of the price of delivered coal.

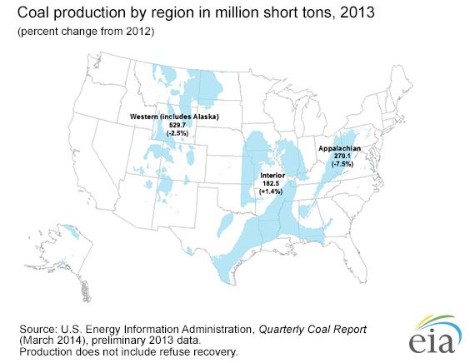

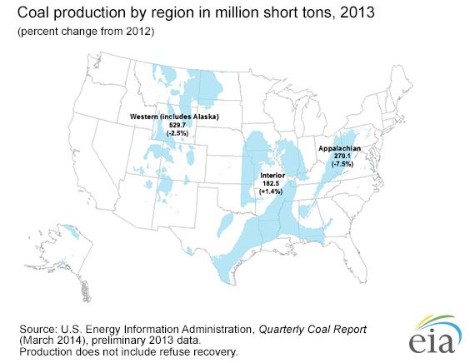

In terms of global production, North America was the second largest coal-producing region in 2010, accounting for about 15% of total production. The U.S. has the most estimated coal reserves in the world, with production in 25 states. The U.S. accounted for 93% of North American coal production in 2010, with about 1.1 billion short tons.

Natural Gas

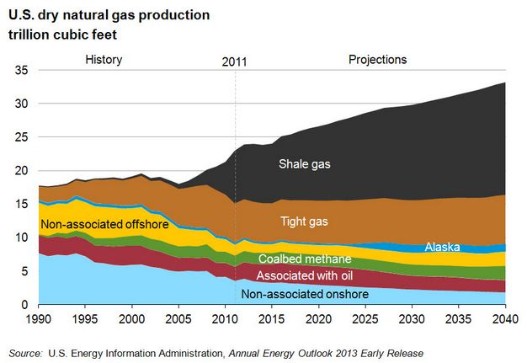

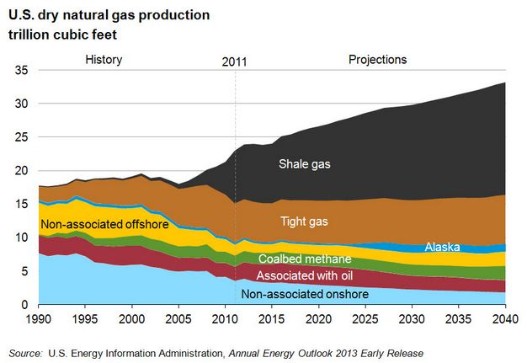

The fall in gas prices in the U.S. that has accompanied the shale gas boom has begun to stimulate investment in new gas power plants. However, electric utilities are very sensitive about making long-term investments that rely on natural gas – a fuel that has a history of surprise price changes and lacks unified markets– because they are often prevented by state laws and utility commissions from increasing consumer rates when fuel prices increase.

Continued growth in natural gas exports from the U.S. and falling imports of natural gas to the U.S. during 2010 accounted for the decline in net imports, which fell despite a 6% growth in domestic natural gas consumption during the year. In 2011, 95% of natural gas consumed in the U.S. was produced domestically.

With dry gas production at its highest level since 1973, increased domestic sources of natural gas have helped maintain competitive prices and discouraged imports while encouraging exports.

Nuclear Fission

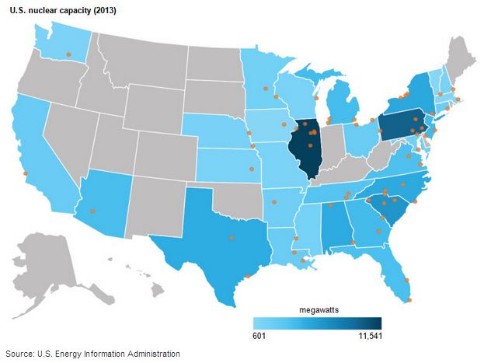

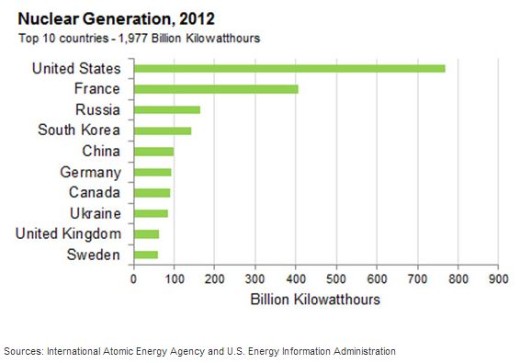

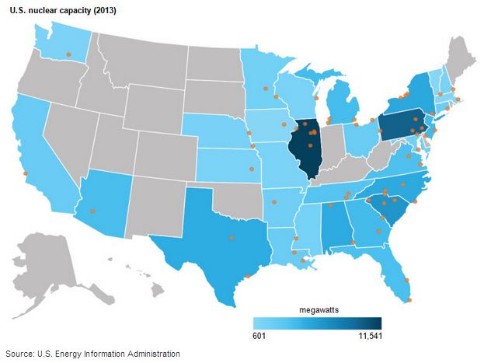

The U.S. currently has 62 power plants in 31 states, with 100 nuclear reactors. Electricity production averages around 20%.

Most of the cost for nuclear power is fixed in up-front infrastructure. History has shown that the budget for new nuclear reactors, already high, is very often exceeded. An assessment of 75 of America’s existing reactors showed predicted costs to have been $45 billion, but the actual costs were $145 billion. However, once a plant is complete and running, the variable cost of fuel only adds a small amount to the price of electricity generated.

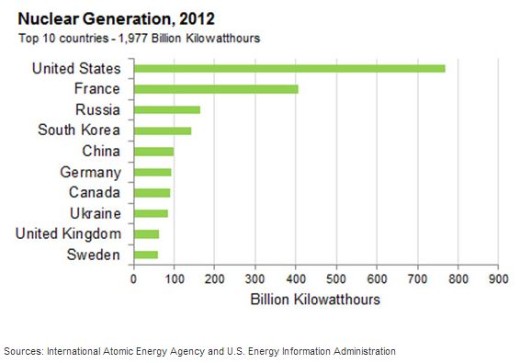

The United States has the most nuclear capacity and generation among the 31 countries in the world that have commercial nuclear power. But every U.S. power plant will need to be replaced by 2050. France, the country with the second most nuclear capacity, relies on nuclear power for almost 80% of its electricity.

Nuclear Fusion

Nuclear Fusion

Bringing fusion power to a level that it is commercially viable will require significant research and development spending, estimated at about $35 billion over a 15-year period (or $2.33 billion per year). In comparison, the Manhattan Project totaled $22 billion over 5 years; the Apollo program totaled $98 billion over 14 years.

Once commercialized, power plants are likely to require a high initial construction cost and low operating costs. Fusion has the potential to be a long-term source of energy, but it will require significant and sustained investment in order to meet the engineering and scientific needs required.

Several other countries, notably Japan and the European Union, have provided steady support over the past twenty years to upgrade fusion experiments and build new facilities. Japan allocated approximately $335 million to accelerator and fusion-related work in 2004. By comparison, the U.S. Department of Energy spent about $257 million on Fusion Energy Science work that year. The fiscal year 2015 request is $416,000 million.

Renewable Power

Of the five types of renewable power, only conventional hydroelectric is consistently competitive on cost of generation with fossil fuels. In areas of the country with consistent and strong winds, installing new wind turbines is already price competitive with new fossil-fuel generation, without subsidies. In 2013, renewables were responsible for 13% of U.S. electricity demand.

Solar power’s economic benefit is its compactness and versatility. It does not require large, expensive solar arrays to generate power. Instead, small units can be installed to offset the costs of electricity. With proper legal regulations (not implemented in all states), consumers can install solar power on their property – likely on their roof – and defray the monthly cost of electricity. At times of low household usage, they can even sell the electricity back to the grid.

The demonstrated benefits of generating electricity without using a polluting fuel are a benefit that the government has an interest in promoting.

China is emerging as the world’s clean energy powerhouse. In 2009, China became the world’s largest investor in clean energy, investing $34.6 billion and pushing the U.S. into the second place position. In recent years China has built a strong manufacturing base and export markets, and is now working to meet domestic demand. The Chinese have announced plans to install 10 gigawatts of solar capacity by 2015, supported by a feed-in tariff and government mandates; this is five times the U.S.’s current installed capacity.

Coal

Coal

Nuclear Fusion

Nuclear Fusion