The Race Between the U.S. and China to Sell Electric Vehicles

Rising demand for electric vehicles (EVs) worldwide has resulted in a competition between both manufacturers and great powers. While automakers like Tesla and China’s BYD Co. compete for sales revenue and market share, the U.S. and China are competing for influence and energy independence. It might seem like manufacturers and their parent nations are fighting separate battles, but they depend on each other for success and supply each other with the critical tools they need to innovate and remain competitive.

Market Forces & International Competition

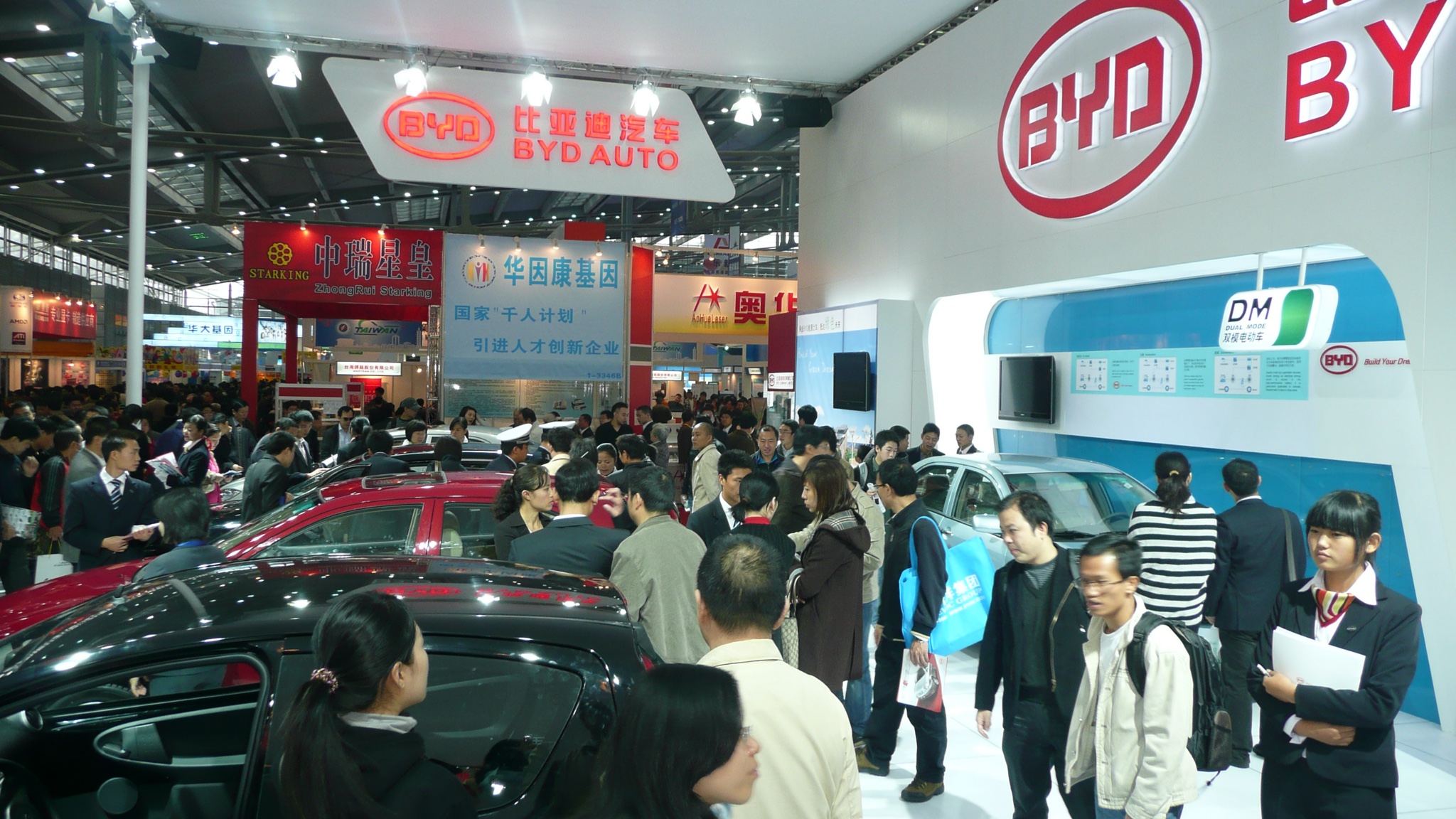

A few manufacturers in the U.S. and China largely dominate the global EV market. In the U.S., Tesla and General Motors account for about half of the 358 thousand EVs sold in 2018. In China, BYD Co. and BAIC produced about one-third of the more than 500 thousand EVs sold in China during 2017.

China has, by far, the largest market for EVs, and Chinese state-owned manufacturers collectively are the highest volume producers of EVs. For much of the last decade, China was largely unopposed in its position as the global leader in EVs; however, changing consumer demands have begun to shift this dynamic in favor of western manufacturers, and Tesla in particular.

Today’s EV consumers are increasingly choosing safer, more technologically advanced EVs. Improvements in battery and charging technology have made EVs more practical for everyday use. Additionally, consumers have shown they’re willing to pay more for the technological innovations and safety features offered by Tesla.

While the U.S. has invested heavily in technological innovation, China has invested in EV infrastructure. The Chinese government has been installing thousands of charging stations per month for years now, and China’s public EV charging infrastructure currently dwarfs that of the U.S. Projections suggest that more than one in three Chinese cars will be EVs by 2030. In contrast, less than one in seven vehicles in the U.S. will be EVs by 2030. China’s infrastructure investment will pay dividends in terms of energy security and reductions in greenhouse gas emissions.

The Future of EV Technology and Energy Security

More than two-thirds of the 20.44 million barrels of oil consumed per day in the U.S. goes into the engines of vehicles used for transportation and shipping. If renewables, such as solar, wind, or hydroelectric power, charged cars, the U.S. would be less dependent on foreign oil, produce fewer carbon emissions, and have cleaner air.

To harness renewable energy sources for EVs, developments in battery storage capacity is crucial. Six U.S. government agencies spent a combined $1.3 billion between 2009 and 2012 on projects and initiatives aimed at developing more efficient batteries, and that number has grown since.

Battery innovation is also a focus of technological innovation among EV manufacturers. Tesla recently spent hundreds of millions of dollars acquiring a battery developer that hopes to increase the longevity of EV batteries. For EVs to cost less than internal combustion engine vehicles, the cost per kilowatt-hour (kWh) needs to be below $150. In 2010, the price per kWh of EV batteries was $1000. Today, Tesla’s Model 3 costs $190 per kWh. Some studies predict that with proper investment in the technology, the cost of EV batteries could drop to as little as $73 per kWh by 2030.

However, the development of EV batteries by U.S. manufacturers comes with a catch. China produces almost two-thirds of the world’s lithium-ion batteries and controls the global supply chain. Tesla is the only U.S. EV manufacturer that produces any significant number of its EV batteries. Without the ability to produce more EV batteries, the U.S. may lag behind China in EV production, and EVs may compete with the renewable sector for limited battery storage resources. That competition will drive the price of both EVs and renewable energy up and will slow the adoption of two revolutionary technologies.

Establishing independent supply chains, increasing the production of EV batteries, and investing in the development of better batteries should be a national security priority for the U.S. If EVs prosper, innovations that reduce U.S. reliance on imported oil will surely follow. Reducing U.S. reliance on foreign oil has been a long-term security goal, and advancements in EVs have the potential to make dependence on foreign energy a thing of the past.

The New National Spotlight on EVs

U.S. manufacturers have made enormous strides in recent years, but more investment is needed to improve battery technology and increase demand. U.S. policymakers have taken notice and recognize that to compete with China they must step up investment.

U.S. Senate Minority Leader Chuck Schumer has proposed tax credits for consumers seeking to trade in gasoline-powered vehicles for EVs. Additionally, his proposal includes grants to states to develop EV charging infrastructure and to manufacturers to improve battery technology. House Democrats also introduced legislation seeking to extend or expand tax credits for plug-in EVs and to encourage states to update building codes to integrate EV charging stations.

More recently, Vice President Biden’s $2 trillion green energy campaign plan includes similar provisions. The former Vice President wants to provide funding to build a zero-emissions public transit system in every American city with 100,000 or more residents. His plan also suggests he would accelerate the installation of new EV charging stations and reform how the American auto industry gets materials for EV batteries.

However, providing a supply of EVs and the infrastructure to support them is only one part of the equation. The U.S. must also find ways to stimulate consumer demand, and the tax credits proposed by Congress will be helpful. Younger consumers in the U.S. are much more interested in EVs than older consumers, and falling prices are increasingly putting EVs within reach for younger U.S. consumers. In China, however, trends in vehicle density and public transport suggest that Chinese consumers are less eager to purchase a personal vehicle than American consumers are. Encouraging these demographic and attitudinal shifts could be a major boon for EV adoption and competition in the U.S. in the coming decades.

Great power competition between the U.S. and China has spread to the market for EVs. China’s large market has given it an early boost, but consumer-driven technological advances in the U.S. are driving the next wave of global EV sales. Despite recent advancements, the U.S. still faces a few challenges. State and federal policymakers should make investments in developing and producing EV batteries, installing EV infrastructure, and incentivizing EV adoption. Doing so will improve American air quality and competitiveness vis-à-vis China, as well as reduce U.S. reliance on foreign oil and total U.S. carbon emissions. It’s a win-win.