Risks and Opportunities: Chinese Direct Investment in U.S. Unconventional Oil and Gas

This is a Guest Post from Frauke Heidemann and Patrick Renz, Graduate Students at Tsinghua University in Beijing, where they are CSIS Pacific Forum WSD-Handa Fellows. They run the IR.ASIA network, where they have interviewed many of the leading scholars about China’s energy security. Many of them, including their interview with yours truly, are well worth a read. This is the first of a series they are writing for ASP on US-China strategic energy relations.

The success of unconventional oil and natural gas production in the United States is attracting investments from all over the world. China has been watching closely. With a growing reliance on imports of oil and natural gas, ambitious production goals for 2015 and 2020 in unconventionals, and with Premier Li Keqiang declaring war against pollution, China would dearly like to replicate America’s successes.

The private sector offers huge opportunities for both sides to both increase profits and increase cooperation. In 2013 alone, China invested $3.655 billion in the U.S. energy industry. Of that, $3.2 billion were directed towards the unconventional oil and natural gas sector, making it a major driver of Chinese Foreign Direct Investment (FDI). Renewed intergovernmental initiatives through the Strategic & Economic Dialogue between the U.S. and China have sought to push this forward.

As ASP pointed out in an earlier post “Balancing the Risks and Benefits: Chinese Investment into U.S. Energy”, since the bad experience with the China National Offshore Oil Company Ltd (CNOOC) bid for UNOCAL back in 2005, Chinese enterprises investing in the U.S. unconventional oil and natural gas sector have primarily focused on minority stakes. Such investments by Chinese National Oil Companies (NOCs) have been criticized due to concerns about national security, cyber attacks, intellectual property as well as proximity to military installations. However, the cautious investments by NOCs and other Chinese State Owned Enterprises (SOEs) in the U.S. unconventional oil and natural gas sector has helped to lower the perceived negative impact from such investments.

Belying the negative perception of Chinese investments, cooperation between U.S. and Chinese companies offers benefits for both sides. Increased shale gas production has caused a low natural gas price that has put many U.S. energy companies in financial distress – and thereby in need of investors to raise greatly needed capital. We see this in recent examples like the deal between Pioneer Natural Resources and Sinochem for a 40% stake of the Wolfcamp Shale in January 2013 and Chesapeake Energy’s low selling price for the Mississippi Lime joint venture with China Petroleum & Chemical Corp. (Sinopec) in June 2013. As Pioneer Natural Resources is like many others looking for opportunities outside unconventional natural gas, the Wolfcamp deal helps to finance the much more lucrative development of unconventional oil.

|

Major Chinese Investments in the U.S. Unconventionals Industry |

|||

|

Year |

Chinese Company |

Project |

Value |

| 2014 | Shenhua Energy | Energy Corporation of America; Shale gas joint venture for the development of a project including 25 natural gas wells in Pennsylvania | $90 million (only resembling drilling costs, remaining expenditures will be split evenly) |

| 2013 | Sinopec | Chesapeake Energy; 50% stake in Mississippi Lime formation | $1.02 billion |

| 2013 | Sinochem | Pioneer Natural Resources; 40% stake in the Wolfcamp Shale | $1.7 billion |

| 2013 | CNOOC | Nexen; U.S. Operations | Total deal: $15.1 billion (Canadian company) |

| 2012 | Sinopec | Devon Energy; 1/3 stake of its acreage in five emerging fields: four shale plays and one limestone field | $2.5 billion |

| 2011 | CNOOC | Chesapeake Energy; 33% stake in Chesapeake leases in Colorado and Wyoming | $570 million + funding of 2/3 of drilling and other costs of up to $697 million |

| 2010 | CNOOC | Chesapeake Energy; 33% stake in Eagle Ford play | $1.08 billion |

For Chinese SOEs, investments in the U.S. unconventionals industry have a variety of positive impacts that go far beyond the proclaimed technology and know-how gain. Joint ventures, even with cautious minority stakes investments, will help Chinese SOEs to learn about the technologies and engineering processes that helped the U.S. create the current unconventionals boom. However, these deals do not come with a secondment of personnel or agreements to transfer technology, so a mere focus on increasing know-how and gaining access to technologies can’t be the sole reason. Perhaps more importantly, these joint ventures help to deepen ties between U.S. and Chinese companies, resulting in further collaboration on projects outside of the U.S., where the exploration for unconventional natural gas is picking up pace. Given the importance to secure supply globally, there is nothing negative about such cooperation.

Additionally, the interest of Chinese NOCs in the U.S. unconventional industry is simply following the logic of numerous other interested foreign energy companies. Once market entry was successful, there is little potential for any disruptions or complications and the companies are offered the potential of financially lucrative investments in a physically and legally secure environment. For the first time since 2001, the U.S. ranked No. 1 in the A.T. Kearney’s June 2013 FDI Confidence Index. These Chinese investments might thereby be a first step of Chinese NOCs becoming more mature investors, trying to not only diversify the source countries of its energy imports but also the risk portfolio of its investments.

Driven by unconventionals production in the U.S., investments beyond the simple acquisition of stakes in unconventional shale plays have become a target of Chinese FDI. As recently announced by China’s Clean Energy Commercialization Corporation, a joint venture between British Petroleum and the Chinese Academy of Sciences to start the company Northwest Innovation Works shows the potential positive effects from such investments. Profiting from the low natural gas price, the company wants to operate two $1 billion plants to refine natural gas and export methanol from the Pacific coast of the U.S. to supply China’s petrochemical industry. The project claims to be built following the highest environmental standards and create jobs in the U.S., bringing additional positive effects from the investments of Chinese SOEs in the U.S.

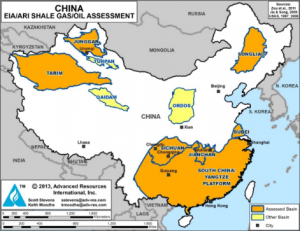

Commercial issues notwithstanding, it is important to keep in mind that Chinese SOEs are always linked to the Chinese government in some way – and they will not lose this controversial link. Thereby, cooperation between the Chinese and American governments remains an important foundation for these investments to continue. If the two governments prolong this trend, increased access for U.S. companies to the Chinese unconventional oil and gas is possible in the future – giving new investment opportunities that will ultimately develop China’s vast unconventional fossil fuel reserves.

[…] in Beijing. This is the second of a series on US-China strategic energy relations. The first, Risks and Opportunities: Chinese Direct Investment in U.S. Unconventional Oil and Gas, was published in May. The third will be published next […]

[…] This is a Guest Post from Frauke Heidemann and Patrick Renz, CSIS Pacific Forum WSD-Handa Fellows and Graduate Students at Tsinghua University in Beijing. This is the third of a series on US-China strategic energy relations. Previous ones are “Four Key Challenges to Increasing U.S. Private Investment in Chinese Shale Gas” and “Risks and Opportunities: Chinese Direct Investment in U.S. Unconventional Oil and Gas.” […]