energy.gov

energy.gov

Wind Energy’s Production Tax Credit: Opportunities Created by the Clean Power Plan

This is a post from Andrew Landrum, a current Juris Doctor candidate in University of Richmond School of Law. He presents his idea about the opportunities created by the Clean Power Plan from the wind energy’s production tax credit.

The United States’ wind industry has reached a critical point in its development. Recent innovations, supported by federal and state programs and private sector investment, position the industry to assume a critical role in future state compliance strategies mandated by the Clean Power Plan (CPP). However, at the end of 2014, a key source of federal support – the Wind Production Tax Credit (PTC) – expired for all projects not yet in construction after 2014. If Congress hopes to fully capture wind’s momentum in time for integration into state CPP compliance plans, a long-term renewal of the Wind PTC should be considered.

The Environmental Protection Agency’s CPP is a newly finalized set of standards meant to regulate emissions produced by power plants. The plan establishes state-by-state targets for carbon emission reductions and allows each state to adopt its own plan for meeting these targets. The state plans may include energy efficiency measures, shifts away from dirtier fossil fuels, or investments in renewable energy, including wind power. American Security Project has previously commended the CPP for its efforts to address climate change and the opportunities it creates for near shore wind power.

Using the CPP’s mandate as a catalyst for industry growth would benefit domestic manufacturing industries and create jobs. The Department of Energy released a comprehensive report in 2015, Wind Vision, and found more than 600,000 wind-related jobs could be supported by a robust wind industry. Wind supports a large supply chain, benefiting services such as manufacturing, transportation, and facility installation and maintenance. The planning, building, and operating requirements of a standard facility’s lifetime alone are estimated to create 1,079 jobs. Wind power provides a standalone reliable source of energy or could serve as a long-term hedge against increases in natural gas prices. Either way, opportunities created by the CPP provide strong incentive to support the long-term development of wind power as a cost-effective source of clean energy.

Now is the time for such development as costs are at an all-time low. According to the Department of Energy’s recently released 2014 Wind Technologies Market Report, wind energy prices offered by developers to utility purchasers dropped to a record low of 2.5 cents per kilowatt-hour. Federal and state support, together with private industry development, have resulted in cost efficient technologies, making wind increasingly competitive with traditional forms of production. New turbine innovations, such as larger components, longer blades, and taller towers, increase efficiency and lower prices. Such innovations have created resurgence in wind installation and investment. In 2014 alone, the United States saw an addition of 4,854 megawatts of new capacity and a total of $8.3 billion in new investments, constituting an 8% growth of wind capacity since 2013.

The scaling turbine advancements also expand wind energy’s flexibility. Previously untapped regions across the country are now economically viable sites for wind energy generation. A recent analysis by the non-partisan U.S. Energy Information Administration (EIA) highlighted the CPP’s mandate as a new opportunity for every state to incorporate wind energy into its compliance strategies. Additionally, a separate section of the Department of Energy’s Wind Vision report highlighted the potential for wind energy’s implementation in all 50 states and, assuming continued growth, its ability to generate sufficient electricity to meet 35% of national demand by 2050. However, the report tempered optimism by stating that because of “the latest expiration of the federal production tax credit (PTC), this robust growth is not projected to continue.”

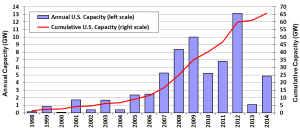

The PTC was established in 1992 to provide developers with inflation-adjusted credit for the first 10 years of a facility’s operation. Since its adoption, the PTC has been invaluable for the expansion of the wind industry, as illustrated by the lulls in wind additions during the years in which it was allowed to expire. Investors and renewable developers rely on the PTC’s continuance for wind price projections, as these are long-term investments. The chart below, cited in the 2014 Market Report, illustrates the connection between wind capacity additions and the PTC’s availability, as the it clearly indicates a significant drop in capacity growth during the years in which the PTC lapsed – 2000, 2002, 2004, and 2013.

Annual and Cumulative Growth of Wind Power Capacity

Again, at the end of 2014, Congress allowed the PTC to expire. All facilities not, at minimum, labeled “under construction” by the end of last year no longer qualify for the PTC and remaining projects still receiving aid will lose such support by 2016. Therefore, while wind technology advancements and CPP compliance strategies provide opportunities for long-term expansion, continued growth remains uncertain due to unforeseeable market conditions created by the PTC’s expiration.

The PTC was integral in securing 2014’s record-low generation cost of 2.5 cents per kilowatt-hour. While new opportunities created by technology advancements and CPP compliance strategies are promising, such incentives cannot replace the PTC’s benefit in maintaining low wind prices. A recent report by the Government Accountability Organization (GAO) found that, without the PTC, wind costs would increase 32 to 64 percent for developers to maintain a project’s profitability. As supported by the chart above and the GAO report, lapses in the PTC have previously delayed planned projects, cost thousands of jobs, and decreased installment up to 92 percent in comparison.

In addition, current uncertainty is having real effects on future wind investment. As stipulated in the 2014 Market Report, manufacturers are weary in investing long-term resources in the domestic wind industry without the PTC. Wind projects are long-term commitments and developers incorporate federal support into preliminary cost projections. Without stable, predictable support, renewable companies may look elsewhere, unable to capture the momentum created by recent wind innovations and investment.

What is needed is a long-term extension of the Wind PTC. The PTC was traditionally extended by year for a short term. At the end of that term, Congress would decide whether to renew the tax credit or allow it to expire. While the PTC is good for the industry, this short-term extension policy insufficiently captures wind’s true potential. This uncertainty potentially deters significant investments into larger wind projects: the planning and permitting process for new facilities can take years and renewable developers want assurance the PTC will continue to exist after the project is completed. A recent report published by the National Renewable Energy Laboratory analyzed three different scenarios in which the PTC: remained expired; was renewed, but incrementally ramped down and eventually terminated; and, maintained through 2020 and beyond. The report clearly showed that, due to uncertainties created by low natural gas prices and electricity demand, only the last scenario, extending the PTC through 2020, provided the “best opportunity to support deployment consistent with recent levels across a range of market conditions [.]” Until the industry establishes significant footing within the national energy market, subsidy phase-out strategies remain vulnerable to considerable uncertainties. Only a long-term renewal of the PTC secures a robust wind energy future.

The CPP creates an opportunity to reintroduce a long-term extension of the Wind PTC. While not a long-term extension, the Senate Finance Committee recently voted 23-3 to extend a two-year extension to the PTC as part of a larger tax package. The bill received broad bipartisan support, signaling future renewable tax legislation may receive more universal support. A renewal in wind’s PTC could fill important competitiveness gaps between wind and other forms of energy production, and unlock its potential in transitioning to a clean economy. Technological advancements have opened up new areas for wind development and have driven down the costs of production. The PTC provides the certainty needed to capitalize on these recent advancements and ensure wind plays a major role in the nation’s future energy mix.