Photo by Sasha Mordovets/Getty Images

Photo by Sasha Mordovets/Getty Images

Russia’s Natural Gas Pivot to Asia: A Reality Check

This is the first post in the series of analysis examining Russia’s energy pivot to Asia. The second article, Inescapable Europe and the Future of Russia’s Natural Gas, will be published at a later date.

APEC China 2014 closed last month with much publicity on its major policy accomplishments. One of them was the second China-Russia natural gas deal following the previous one signed in May 2014. These two deals will connect China to Russia’s two major pipelines in Asia: Power of Siberia and Altai Gas Pipeline. Russia’s “energy pivot” to Asia is increasingly perceived to be a reality due to the two countries’ emerging bilateral natural gas partnership as well as Putin’s latest abandonment of South Stream Project.

Nevertheless, serious challenges question the optimism surrounding the China-Russia gas deals. Russia’s eastward policy may not necessarily translate into a profitable venture for a country desperately seeking to improve its foundering economy with natural gas.

The 2014 China-Russia Gas Deals

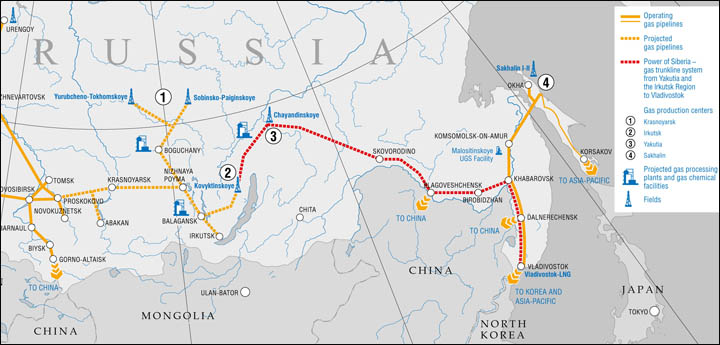

Russia inked two major gas deals with China in 2014. In May 2014, Gazprom and China National Petroleum Corporation (CNPC) signed a $400 billion deal that promised to deliver 38 bcm of Russian gas via the Power of Siberia pipeline for 30 years, beginning in 2018. The two nations struck their second gas deal at $284 billion during APEC and would send China an additional 30 bcm of gas each year through the Altai Gas Pipeline. Unlike Power of Siberia, this pipeline can transfer Russian natural gas from Europe to China.

Geography of Power of Siberia and Altai Gas Pipeline

These two deals would provide China with 68 bcm of gas annually, making the country the largest importer of Russian natural gas, surpassing Germany. Moreover, Russian natural gas is also estimated to account for 17% of China’s gas consumption by 2020.

The coming surge of Russian natural gas in Asia has led to the perception of its expanding regional clout. The two China-Russia deals are considered to have cast a bleak future outlook particularly for LNG exporters eyeing the booming Asian market. For example, the U.S. LNG’s future profitability is estimated to be severely eroded by the low price of gas agreed upon between Russia and China once Gazprom begins sending the commodity to its Asian customer.

A Reality Check

Nevertheless, numerous challenges surround the emerging Russia-China gas partnership. The two pipelines for China are still incomplete and will require considerable investment in capital, labor, and time. Total investments required to develop the two pipelines will be as much as $100 billion, almost one twentieth of Russia’s GDP in 2014.

Moreover, the 2,500 mile Power of Siberia pipeline will be constructed on complex, seismically-active terrain, including swamps and mountains in frigid Russian Far East. The unstable terrain could engender significant cost overruns, potentially requiring further investments. Given Russia’s sanctions-stricken economy, the Power of Siberia project would likely require considerable foreign loans and has little chance of reaching its full capacity until the mid-2030s.

The two deals’ profitability is also questionable. China is demanding a remarkably low pricing at $350 per 1,000 cubic meters of gas, $30 less than what the Europeans currently pay. If the Chinese demand is accepted, Russia’s gas revenues from Asia will be severely constrained. Hydrocarbons make up 30% of Russia’s GDP and 50% of its GDP growth since 2000. Falling oil prices hurt the Russian economy after the 2008 financial crisis and are eroding it again this year. On November 30, Russian ruble reached another historic low of 50.01 against US dollars, a 35 % drop in value in just one year. The Russia-China gas deals could salvage this economic situation over time, but China’s insistence on lower pricing augurs ill for expected profitability. Moreover, questions remain as to the method of the $25 billion prepayment as requested by Moscow.

China is an economic juggernaut. Russia knows this and has struck two gas deals with this Asian giant this year. However, getting there is prohibitively costly. Moreover, the return on investment could also be minimal. These mounting challenges cast a bleak outlook for Russia’s natural gas pivot to Asia.