Increased Energy Security and Strengthened Bilateral Ties: Opportunities for U.S.-China Shale Gas Cooperation

This is a Guest Post from Frauke Heidemann and Patrick Renz, CSIS Pacific Forum WSD-Handa Fellows and Graduate Students at Tsinghua University in Beijing. This is the third of a series on US-China strategic energy relations. Previous ones are “Four Key Challenges to Increasing U.S. Private Investment in Chinese Shale Gas” and “Risks and Opportunities: Chinese Direct Investment in U.S. Unconventional Oil and Gas.”

With China’s shale gas sector still in its infancy, there is a great deal of uncertainty about the economic viability of production. The ambitious targets, which seem to fall short of actual achievements, have attracted a lot of skepticism. Even in late 2013, with governmental subsidies in place, concerns about the closest production targets of 6.5 billion cubic meters per year in 2015 dominated the Chinese press.

With China’s shale gas sector still in its infancy, there is a great deal of uncertainty about the economic viability of production. The ambitious targets, which seem to fall short of actual achievements, have attracted a lot of skepticism. Even in late 2013, with governmental subsidies in place, concerns about the closest production targets of 6.5 billion cubic meters per year in 2015 dominated the Chinese press.

However, from March of 2014 onwards, the Chinese National Oil Companies (NOCs) – Sinopec and CNPC – suddenly became highly optimistic about future production prospects, even increasing their individual production targets. Adding to this, President Xi Jinping vowed in June 2014 to address environmental problems and revolutionize the energy sector. While heading the meeting of the powerful Central Leading Group on Financial and Economic Affairs, Xi highlighted the enormous environmental costs that came with the Chinese energy consumption and production habit of the past. After Xi’s speech, Niu Liu, the economist of the State Information Center, stressed that shale gas production could be a step towards this much needed energy revolution.

Such an energy revolution requires technology and innovation, which for shale gas primarily comes from abroad. The most successful shale gas producer to date have been U.S. based International Oil Companies (IOCs) and the diverse supplier businesses working in the domestic U.S. Their expertise in hydraulic fracturing has a lot to offer. To create the incentives needed in attracting investment from domestic and foreign companies for China’s shale gas sector, reforms of the antiquated structures surrounding its natural gas industry are badly needed. The institutional barriers elaborated on in ASP’s assessment of the “Four Key Challenges to Increasing U.S. Private Investment in Chinese Shale Gas” are currently all undergoing changes, which reflects that there indeed is a political will to start this reforms process.

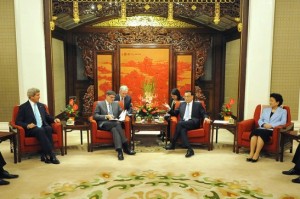

While business level cooperation with both U.S. IOCs as well as supplier companies present in China’s upstream and downstream sectors has been ongoing for many years, shale gas presents a fairly new opportunity. Being confident about its accomplishments and operating from a position of strength, the U.S. has been promoting the exchange of knowledge and technology about the shale gas sector on a governmental as well as business level since the early days of the “shale gas revolution”. Started in the context of the Global Shale Gas Initiative that evolved to the Unconventional Gas Technical Engagement Program after 2010, U.S.-China governmental cooperation looks back at almost 5 years of cooperation. From the initial stage with the Shale Gas Resource Initiative of 2009 to further deepened ties during the 2013 U.S.-China Strategic and Economic Dialogue, both countries continue to highlight the many benefits of cooperation on unconventional resources as elaborated on by ASP.

A press release from December 5, 2013, issued by the White House, pointed out that in order to ameliorate U.S.-China economic relations, the U.S. would encourage technology exports for the purpose of shale gas exploration and development in China. In times of cyber espionage and technology stealing allegations from both sides, having an area where cooperation is encouraged can help to alleviate tensions in overall bilateral relations.

In what seems to be aimed at critical regulatory reforms in China’s energy sector, governmental initiatives are even extended to a Memorandum of Understanding (MoU) between the U.S. Federal Energy Regulatory Commission and the Chinese National Energy Administration. This MoU addresses questions critical for the economic success of shale gas such as the “non-discriminatory open access to gas pipelines,” and shows the commitment of both governments in finding solutions on the most pressing problems for business as well as government cooperation.

For the U.S., the shale gas production boom has contributed greatly to a feeling of increased energy security. As U.S. President Barack Obama announced in his State of the Union of January 28, the U.S. is closer to energy independence than in previous decades. China on the other hand continues to be insecure about growing fossil fuel import dependence. By helping China access its domestic shale gas potential, the U.S. can help increase Chinese confidence about its energy security situation and create opportunities for U.S. companies alongside intergovernmental initiatives. Although it could be argued that strengthening the position of a competitor is wrong, having another major power feel threatened about its vital energy needs – even if those concerns seem uncalled for – potentially destabilizes overall security and further complicates bilateral ties. Subsequently, the benefits both countries can achieve go beyond mere economic considerations and have the potential to strengthen strained bilateral ties in a non-critical area within the critical field of energy security.