Four Key Challenges to Increasing U.S. Private Investment in Chinese Shale Gas

This is a Guest Post from Frauke Heidemann and Patrick Renz, CSIS Pacific Forum WSD-Handa Fellows and Graduate Students at Tsinghua University in Beijing. This is the second of a series on US-China strategic energy relations. The first, Risks and Opportunities: Chinese Direct Investment in U.S. Unconventional Oil and Gas, was published in May. The third will be published next week.

Introduction: China wants Shale Gas, and American Energy Companies Want to Invest in China

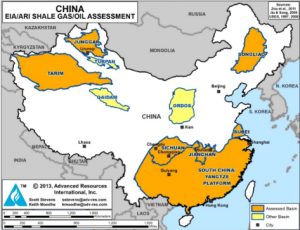

China has watched the U.S. success in unconventional oil and natural gas production closely and has plans to replicate it at home. Estimates by the U.S. Energy Information Administration (EIA) of June 2013 fuel such plans by suggesting that China might have the world’s largest technically recoverable shale gas resources with up to 1,115 trillion cubic feet. While China’s government policies and targets increasingly focus on shale gas exploitation. However, unlike the U.S., tight gas is defined as a conventional natural gas resource and thereby does not profit from the same incentive structures.

Our earlier blog post on ASP already analyzed the risks and opportunities for Chinese direct investments in the U.S. unconventional oil and natural gas sector. Vice versa, U.S. based International Oil Companies (IOCs) and supplier businesses are increasingly finding opportunities in China’s shale gas sector. Many of them have been actively engaged in China since long before the recent shale gas euphoria, cooperating in onshore and offshore conventional oil and natural gas projects with their Chinese counterparts. Since approximately 2010, cooperation in the unconventional sector for shale gas development has increased. Such cooperation ranges from advisory services and joint study agreements (JSA) to joint ventures (JV). Furthermore, collaboration exists in areas such as the production of chemicals for fracking fluids and wastewater treatment (see table at end for details.) With very ambitious domestic shale gas production targets of 6.5 billion cubic meters per year by 2015, China is in need of technology and expertise from foreign companies such as those from the U.S. with experience in shale gas production.

There are four key challenges that are the main barriers to growing U.S. engagement in China’s shale gas sector:

- the higher costs from shale plays in difficult geographical and geological areas,

- market entry restrictions,

- the natural gas pricing system, and

- CNPC’s pipeline monopoly

1. High Extraction Costs

The geography and geology of many shale plays in China is much more challenging than that of U.S. plays. Hosting some of the most promising reserves, the Sichuan Basin is mountainous, has active seismic faults, shale deposits are up to 10,000 feet deep and they contain more clay than those in the U.S. When combined with the anticipated well decline rates (based on U.S. experience) of between 50% to 70% in the first year, production costs will further increase. While some argue that the well decline rates are actually lower in China, the majority of experts we talked to are skeptical about such optimism.

Less mountainous plays in the north of China or the Tarim Basin in Xinjiang Province are located in water scarce areas, making today’s water intensive fracking techniques very difficult and expensive. However, the water challenge also extends to water rich areas such as the before mentioned Sichuan Basin. In these areas, water is intensively used for farming and with already more than 40% of China’s rivers severely polluted, fracking wastewater poses additional challenges. Stricter regulations for water usage and wastewater treatment will however further increase production costs.

2. Market Entry Challenges

The biggest challenge identified for U.S. companies in China continues to be market entry. Even though China’s openness to foreign investment in the energy sector improved after the 2001 WTO accession, there is still a requirement for joint ventures (JVs) in the energy sector. A first sign of potentially eased market access, while not for foreign at least for private investment, can be seen in a recent announcements of Sinopec’s Chairman Fu Chengyu as well as PetroChina and CNPC’s Chairman Zhou Jiping. They said that shale gas development will be opened up to private investment, as demanded by the government-driven reform efforts. This was made possible in December 2011, when the State Council approved the separation of ownership of shale gas from conventional resources and allowed for other firms than only the State-Owned Enterprises to develop shale gas.

The biggest challenge identified for U.S. companies in China continues to be market entry. Even though China’s openness to foreign investment in the energy sector improved after the 2001 WTO accession, there is still a requirement for joint ventures (JVs) in the energy sector. A first sign of potentially eased market access, while not for foreign at least for private investment, can be seen in a recent announcements of Sinopec’s Chairman Fu Chengyu as well as PetroChina and CNPC’s Chairman Zhou Jiping. They said that shale gas development will be opened up to private investment, as demanded by the government-driven reform efforts. This was made possible in December 2011, when the State Council approved the separation of ownership of shale gas from conventional resources and allowed for other firms than only the State-Owned Enterprises to develop shale gas.

3. Unfavorable Domestic Natural Gas Pricing Systems

Aside from those direct regulatory challenges, the natural gas pricing system in China is a further barrier for the willingness to invest. China’s government sets the retail price for natural gas, while LNG prices rely on semi-international markets. Domestic shale gas production costs are still too expensive to break even at those regulated prices. The first efforts to liberate wellhead prices started back in 2011 and in July 2013 the Chinese government extended those reform efforts. Estimates state that netback wellhead prices (citygate prices minus the transportation tariffs) might double over the next three years, which could help as incentive to further develop the costlier shale gas.

4. The Pipeline Monopoly

The last remaining challenge is the pipeline monopoly of CNPC and its subsidiary PetroChina. Due to this monopoly, individual developers have to sell the natural gas they produce at wholesale prices to PetroChina, which for many analysts is seen as additionally de-incentivizing producers from tapping China’s shale gas reserves. PetroChina did however show its willingness to reform by announcing the establishment of a subsidiary containing some gas pipelines, and the plans to subsequently sell said subsidiary. Potentially motivated by the ongoing anti-corruption efforts aimed at CNPC, the partial breakup of the pipeline monopoly might actually become reality.

The last remaining challenge is the pipeline monopoly of CNPC and its subsidiary PetroChina. Due to this monopoly, individual developers have to sell the natural gas they produce at wholesale prices to PetroChina, which for many analysts is seen as additionally de-incentivizing producers from tapping China’s shale gas reserves. PetroChina did however show its willingness to reform by announcing the establishment of a subsidiary containing some gas pipelines, and the plans to subsequently sell said subsidiary. Potentially motivated by the ongoing anti-corruption efforts aimed at CNPC, the partial breakup of the pipeline monopoly might actually become reality.

Conclusion: Reform Ahead?

Many of the named challenges can be overcome by increased reform efforts in China, others have to be addressed through technological innovation. If this path is followed, there will be another area of increased cooperation for U.S. and Chinese businesses within the field of energy security. Even though a survey we conducted among industry insiders showed, that U.S. IOCs continue to be skeptical about the economic success of China’s shale gas production, up-to-date not a single company is completely retracting from its engagement in this sector. Additionally, Chinese companies are being widely optimistic and vocal about their ability to achieve the 2015 production targets, making U.S. supplier companies that are less affected by the four key challenges much more optimistic about the future of their investments in China’s shale gas sector.

[…] Four Key Challenges to Increasing U.S. Private Investment in Chinese Shale Gas Andrew Holland […]

[…] Four Key Challenges to Increasing U.S. Private Investment in Chinese Shale Gas Andrew Holland […]

[…] This is the third of a series on US-China strategic energy relations. Previous ones are “Four Key Challenges to Increasing U.S. Private Investment in Chinese Shale Gas” and “Risks and Opportunities: Chinese Direct Investment in U.S. Unconventional Oil and […]