Cause and Effect: U.S. Gasoline Prices

In Brief:

- Domestic U.S. Gasoline prices are very closely correlated with the price of crude oil.

- Oil prices, in turn, are tied to events largely outside of America’s control.

- Oil prices depend on the interplay of supply, demand, and the perception of future changes in supply or demand.

- The only way to reduce our vulnerability to spikes in oil prices is to use less of it

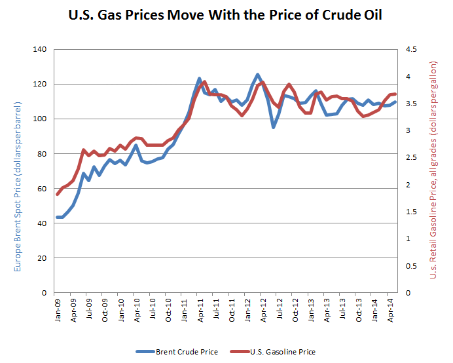

- The price Americans pay at the pump closely follows the trend of the world price of crude oil, as this graph shows. World prices in turn are influenced by the global interaction of supply and demand as well as by expectations of how the price may change in the future

Current Gasoline and Oil Prices

- The national average price of a gallon of regular unleaded gasoline in May 2014 was $3.66

- Gasoline prices often follow a cyclical pattern, rising in the spring, peaking in the early summer, and falling through the autumn. The average for May 2014 is 7 cents higher than the average for May 2013.

- The spot price of crude oil traded at a price of between $96 and $117 per barrel (Brent) in 2013, demonstrating price volatility.

- The current unrest in the Middle East, particularly in Iraq, has the potential to spike the world price for crude oil because of potential supply disruptions in key areas of Iraq and throughout the Middle East.

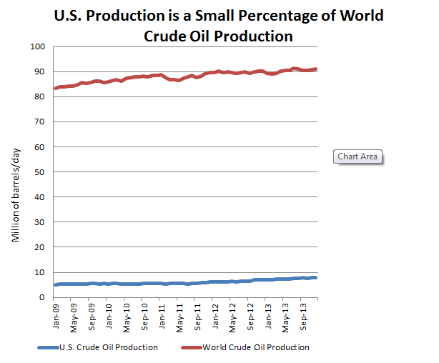

- Even though U.S. production of oil has increased by 35% since March 2007, the surge is barely noticeable when you compare it to the approximately 91 millions of barrels per day (mbd) currently being produced. Our supply is simply not large enough to make a significant contribution to world supplies.

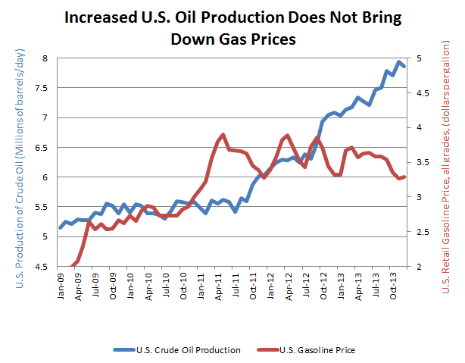

- Since U.S. production has very little impact on global oil prices, the effect on gasoline prices is minimal. This graph demonstrates that in spite of robust increases in U.S. production, the average price of gas has also risen. Rising U.S. oil production simply cannot measurably lower the price at the pump.

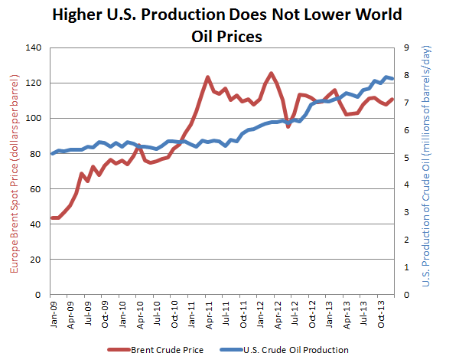

- The surge in U.S. oil production has also not led to lower the price of oil. Even though U.S. crude oil production increased by almost 2.3 million barrels per day from October 2009 to December 2013, the price of oil also increased. This demonstrates the minimal impact that incremental additions to U.S. production have on global oil prices.

Can We Reduce Gasoline Prices?

Although this paper has proved that increased domestic drilling is not a way to reduce oil prices, either in the short or long term, there are ways to reduce oil prices, and there are ways to reduce the impact that high oil prices have on economic growth. None of them, however, are cost-free.

- The Strategic Petroleum Reserve is the only “spare capacity” that the U.S. government controls. Releasing large amounts of oil from the SPR, especially in conjunction with allies around the world, would reduce prices in the short term. Unfortunately, it can be costly to refill the reserve, and draining the reserve in the face of high prices – not an actual disruption in supply.

- A Gasoline Tax Holiday could reduce gas prices by 18.5 cents per gallon, but that reduction would be unlikely to last, and it would have the effect of undermining the Highway Trust Fund, from which highway improvements are funded.

- Restricting Exports of Refined Fuel Products could reduce gas prices for a short time, as the U.S. has become a major exporter of refined fuels like gasoline and diesel. However, altering the free market in such a way would only cause refiners to reduce production of fuel.

- Limiting Financial Speculation in the markets could remove the ability of traders to drive prices up – but it also removes the ability of short-selling traders to drive prices back down. Moreover, in a global oil market, limits on speculation in the U.S. would only drive traders to foreign centers like London.

- Diplomatic Measures to Reduce War Fears would drive down the global price of oil dramatically, if true. A large amount of speculation in the market right now is in regards to the fear that a war with Iran will cause a disruption in markets. If the threat of war were reduced, that fear would ebb, and prices would go down.

Can We Reduce the Harm of High Oil Prices?

While there are few ways to reduce the price of oil that have no side-effects, there are ways to reduce the harm that high oil prices cause. Unfortunately, these are mostly long-term solutions.

- Increased Auto Fuel Economy – one of the most effective ways to reduce the harm that high oil prices cause is for individuals to buy more fuel efficient cars. The deal between the Automakers, the Unions, and the Government to double fuel economy standards by 2025 mean that the American economy is less harmed by price spikes.

- Changing to Alternative Fuels – though not a short term measure, building the infrastructure and technology to have biofuels or other alternative fuels will enable consumers to switch fuels when the price goes up.

- Redesigning Infrastructure – The U.S. is particularly harmed by oil price spikes because we have become so dependent upon cars for daily transportation. Reduced commutes and alternatives to cars, like mass transit, would give consumers the option of not using gasoline when the price spikes.

Key Take-Aways

- The threat of war is driving up oil prices, as is a tight oil market characterized by growing demand for oil in the developing world.

- It has taken us a long time to develop our dependence on oil, and there are few easy solutions to either lower the price or reduce the harm.

- Drilling more will not solve the problem

[…] Cause and Effect: U.S. Gasoline Prices Dan Day The threat of war is driving up oil prices, as is a tight oil market characterized by growing demand for oil in the developing world. […]